Enhance your financial

Next-Gen Solutions for Unbanked Markets: Empowering Financial Access.

Harnessing the global market

potential of financial inclusion and digital payments. It’s never too late to start a digital wallet business, but the sooner you start, the greater competitive advantage you’ll gain.

Launch your financial idea

A ready-made fintech platform to get your PayTech product online in no time.

In weeks, not years

Share your product ideas with us and make it a reality.

Don't Get Left Behind

Why Now is the Perfect Time to Embrace Fintech.

Unlocking Financial Inclusion

Over 1.7 billion adults worldwide still lack access to formal financial services.

Market of the Future

By 2026, global digital payment transactions are expected to amount to USD 10.07 trillion, with a compound annual growth rate (CAGR) of 13.5%.

Emerging Economy Advantage

Discover vast opportunities for expansion in digital wallet solutions within rapidly changing economies.

Regulatory Support

Governments and regulatory authorities actively advocate for the promotion of financial inclusion initiatives.

ALL-ROUND ECOSYSTEM FOR YOUR BUSINESS

Digital wallets and more: All you need to succeed

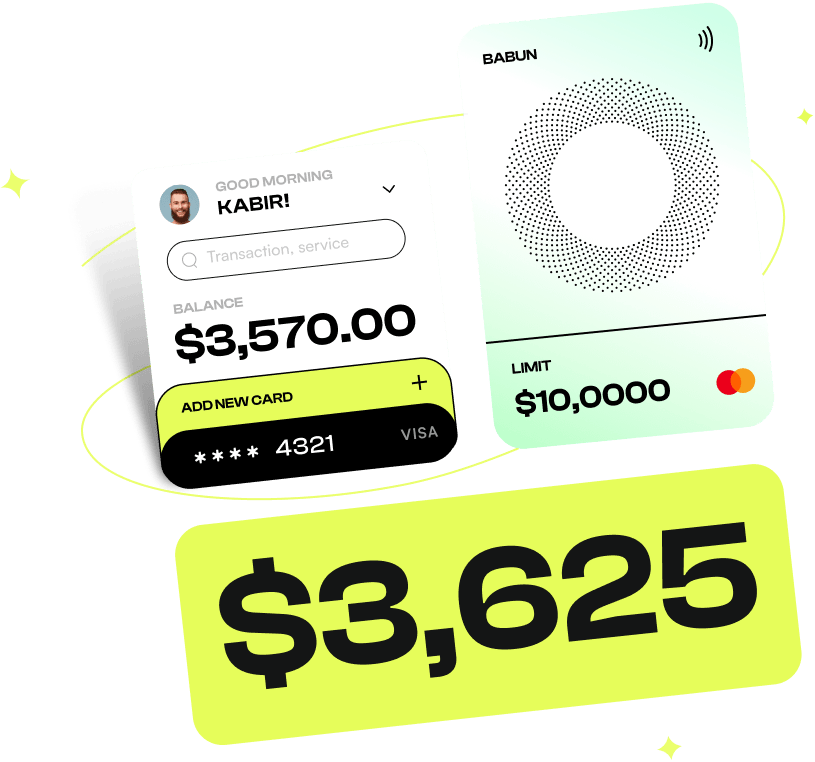

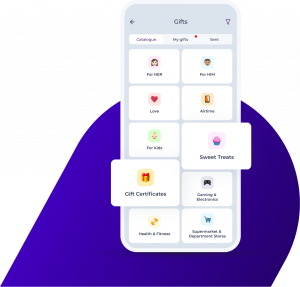

Seamlessly Integrated Digital Wallet

Experience the convenience of a separate payment instrument with a built-in ledger and personalized loyalty reward functionality, captivating customers and enhancing their financial journey.

- VISA Mastercard

- Apple Pay

- Google Pay

- NFC

- QR

- API Mobile money

- Loyalty points

- MobilePOS

Seamlessly Integrated Digital Wallet

Experience the convenience of a separate payment instrument with a built-in ledger and personalized loyalty reward functionality, captivating customers and enhancing their financial journey. VISA Mastercard Apple Pay Google Pay NFC QR API Mobile money Loyalty points MobilePOS

Seamlessly Integrated Digital Wallet

Experience the convenience of a separate payment instrument with a built-in ledger and personalized loyalty reward functionality, captivating customers and enhancing their financial journey. VISA Mastercard Apple Pay Google Pay NFC QR API Mobile money Loyalty points MobilePOS

Wallet operators

Providing businesses with personal financial services for their customers

Banks

Enabling banks with digital transformation benefits of all-round financial platforms

Telecom

Helping mobile providers with new ways to win wider customer audiences

Retail

Ensuring merchants and agents with greater monetization opportunities

WHY CHOOSE US

Great business prospects at your disposal

The reasons why banks and NBFIs in developing regions choose to implement our Digital Wallet platform:

Grant the underbanked population the opportunity to utilize digital financial services such as money transfers, payments, and savings options.

The increasing prevalence of mobile phone usage has paved the way for the seamless integration of mobile-based financial services like Digital Wallets and Rewards.

Digital wallets create additional revenue opportunities for banks and NBFIs by maximizing transaction fees and generating income through partnerships with third-party entities.

Engagement Enhance customer interaction through a hassle-free and intuitive platform designed for seamless financial transactions.

Banks can rely on a dependable wallet business due to their successful track record of implementations across different markets.

In today’s rapidly evolving financial landscape, the availability of digital financial services from numerous banks and fintech companies is on the rise. To gain a competitive advantage, it is crucial for a bank to possess a resilient and user-friendly Digital Wallet platform.

With a deployment timeline of 3-4 months, banks can efficiently launch their digital wallet services and promptly start meeting customer needs.art serving customers.

Seamlessly integrate with the existing core banking system of a bank to facilitate frictionless operations and data exchange.

Pay for SUCCESS

A Promising Investment in Digital Wallet Business You pay only for the number of transactions successfully processed via Cloud Pay platform

Pricing Model

- Our provides personalized pricing plans designed to cater to the unique requirements and size of your institution.

- Select from a range of adaptable choices, such as licensing fees and transaction-based structures.

- Our pricing is clear and directly correlates with the benefits offered by our digital wallet solution.

Cost-saving Benefits

- Our solution aims to optimize manual workflows, cutting down on operational expenses linked to paperwork.

- Reduce costs associated with brick-and-mortar locations and cash management by utilizing our solution.

- Transition to digital processes to enhance efficiency and lower expenses connected to conventional payment methods.

Revenue Generation

- Enhance customer interaction and foster loyalty by providing a flawless digital journey.

- Exploit opportunities for increased revenue by implementing transaction fees and collaborating with merchants.

- Maximize profits by offering value-added services and premium features to generate supplementary revenue.

Return on Investment

- Maximize your return on investment by boosting customer acquisition and retention rates.

- Utilize our cutting-edge digital wallet platform to unlock new avenues for cross-selling.

- Enhance operational efficiency and optimize resource allocation, leading to significant cost savings

Company

Support

Copyright © 2024 Cloud Pay Fin Tech. All Rights Reserved