Digital Wallets for Banks: Get Faster Opportunities to Acquire Unbanked Population

Enhance your revenue growth by leveraging digital wallets to effortlessly tap into unbanked markets, breaking down obstacles to conventional banking services and engaging with untapped audiences. Adopt a cost-effective, rapid time-to-market strategy to broaden your bank’s reach.

EMPOWERING FINANCIAL INCLUSION

Cloud Pay Fin Tech is a prominent digital wallet platform that empowers financial inclusion. We specialize in serving banks and non-banking financial institutions in developing markets across Africa, MENA, and LatAm. Our primary objective is to facilitate the shift from a cash-dependent society to a cashless one, with the ultimate goal of integrating unbanked individuals into the financial system through our esteemed clients.

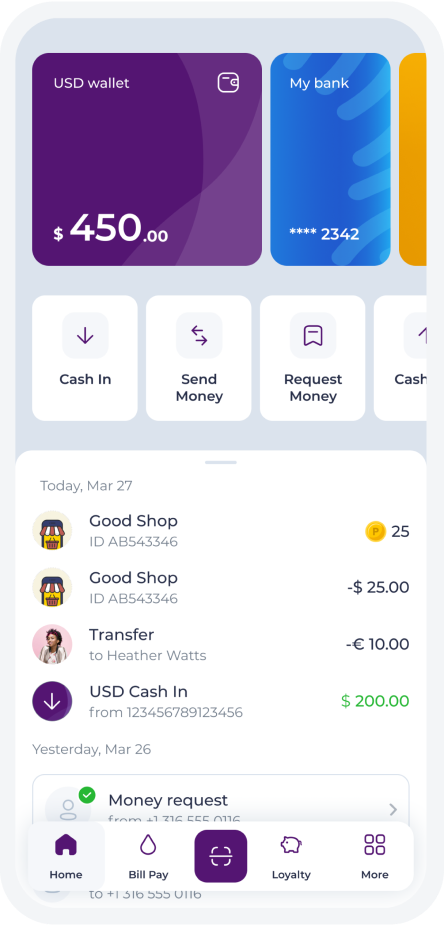

Seamlessly Integrated Digital Wallet

Discover the ease of using a dedicated payment tool that comes with an integrated ledger and customized loyalty rewards feature, captivating customers and enriching their financial experience.

Seamlessly Integrated Digital Wallet

Discover the ease of using a dedicated payment tool that comes with an integrated ledger and customized loyalty rewards feature, captivating customers and enriching their financial experience.

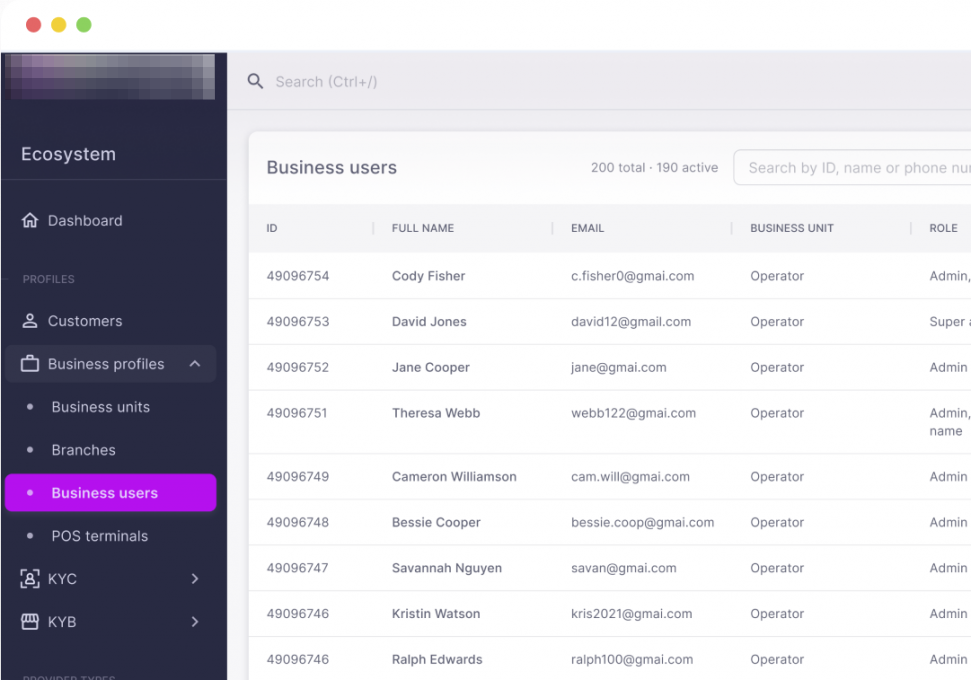

Comprehensive Ecosystem Tools

Bring together customers, vendors, representatives, and various payment methods on a single robust system. Our ecosystem solutions promote smooth integrations, opening up fresh opportunities for financial transactions and engagements.

SOLUTION HIGHLIGHTS

Stay Ahead with Digital Wallet Platform by Cloud Pay

Simplified Onboarding Process

Access financial services instantly with a smooth, completely digital onboarding process. No need for physical paperwork, guaranteeing quick account activation. Our inclusive approach caters to individuals from various backgrounds, genders, and education levels

Multiple Wallet Levels

Customized wallet tiers with different transaction limits according to user profiles. Users have the option to increase their transaction limits by submitting extra documents digitally.

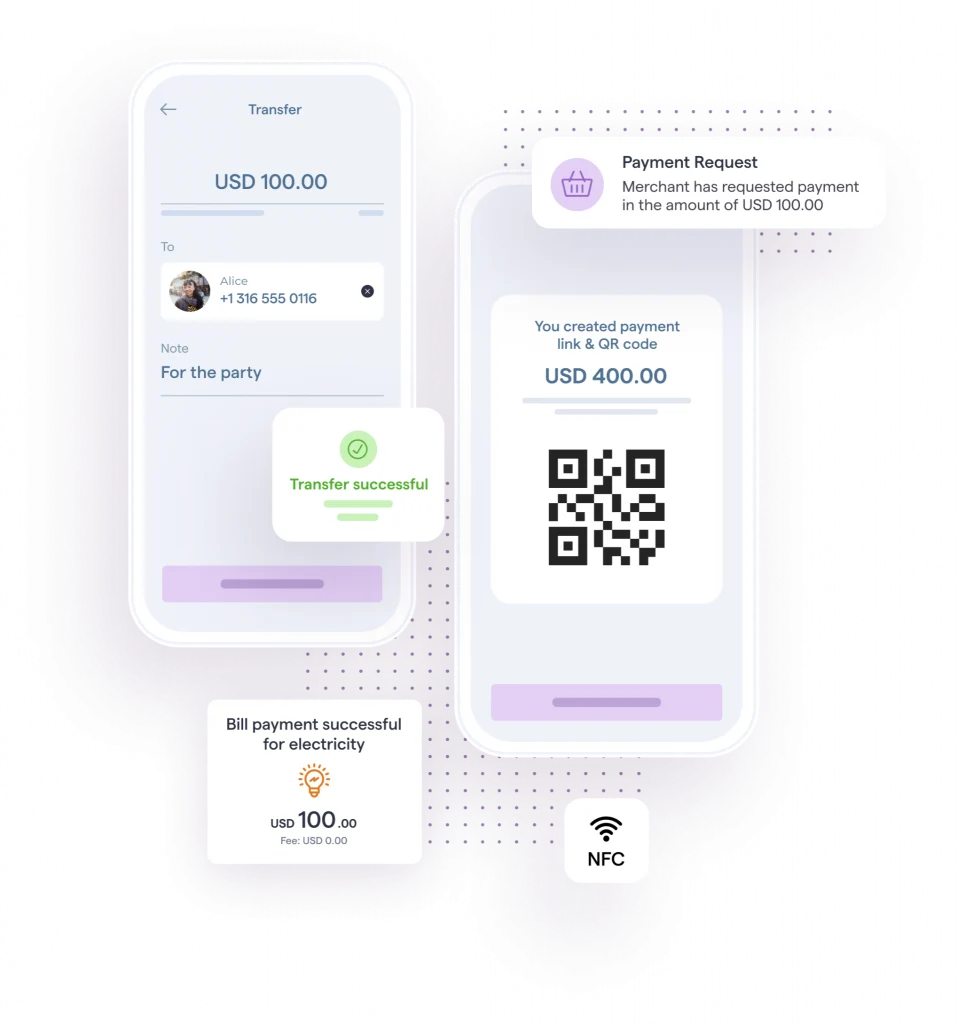

Versatile Transaction Options

Peer-to-peer transfers for seamless money exchanges between individualsBill payments to utility companies, schools, and government officesQR code payments empower merchants for easy and secure transactions Direct salary payments to digital wallets, reducing transaction costs

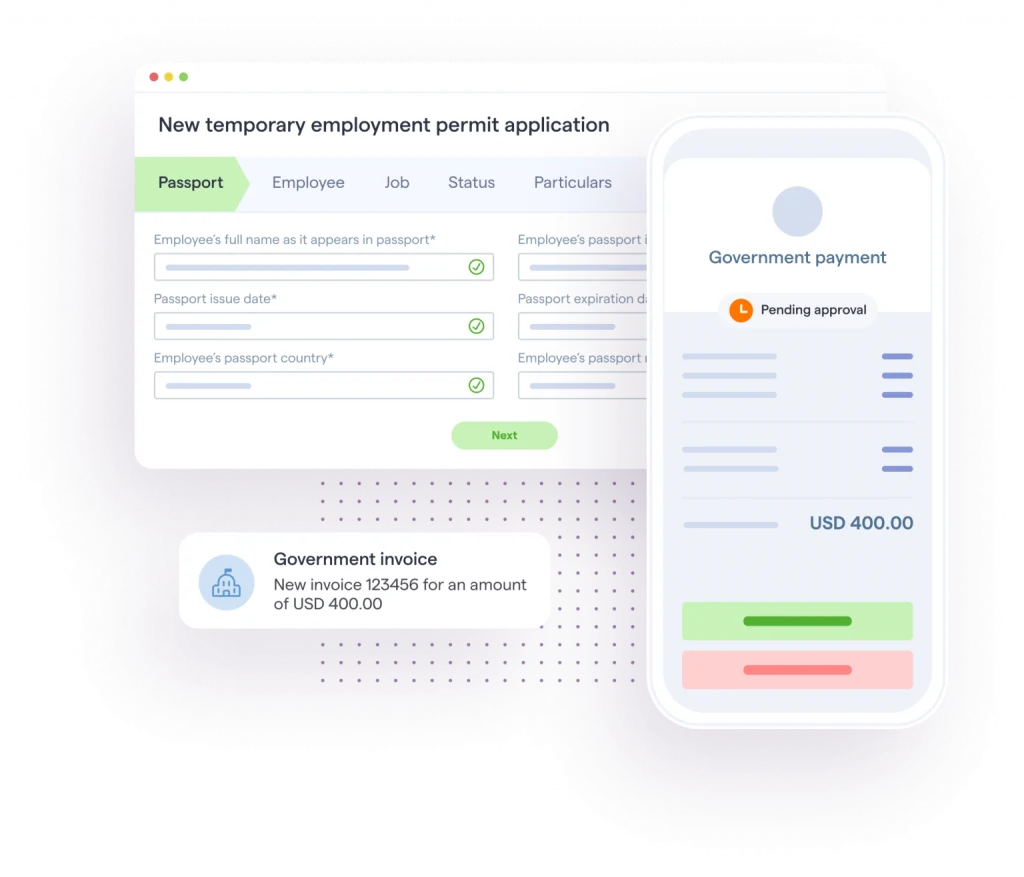

Government Payment Integration

Simplified government payments for work permits, immigration, taxes, and certificates.A convenient and effective way to finalize government-related transactions.

Cashless Top-up and Cash-out

There are various options available to add funds to your wallet, such as retail agents and linked bank accounts. Additionally, our platform offers a convenient cash-out feature that allows you to effortlessly transfer electronic money from your wallet to your bank account.

Expense Tracking and Budgeting

Efficient expense tracking functionality for monitoring and managing income and expenditures. Intuitive digital solution that replaces the need for manual expense recording techniques

GETTING A COMPETITIVE EDGE

The Benefits of Implementing a Digital Wallet Platform by Cloud Pay

Embrace the benefits of Our Digital Wallet Platform for your banking business:

Increased Customer Base and Revenue Streams

Reach untapped market segments, including the unbanked population and underserved communities Attract new customers seeking convenient and accessible financial services.Generate additional revenue through transaction fees, merchant partnerships, and value-added services

Strengthened Customer Relationships and Loyalty

Provide a seamless and userfriendly digital experience, enhancing customer satisfaction.Build stronger relationships by meeting evolving financial needs. Foster customer loyalty through personalized offerings, rewards programs, and targeted promotions.

Market Differentiation and Competitive Advantage

Stand out from competitors with innovative digital banking solutions Position your bank as a leader in financial technology and digital transformationDifferentiate your brand by addressing the specific needs of unbanked populations and underserved segments

Cost Savings and Operational Efficiency

Reduce reliance on physical branches and associated costs Streamline manual processes and paperwork with digital onboarding and transactionsLower operational expenses through digital payments and automated processes

FLEXIBILITY AND SECURITY

Empowering Banks with Customization and Peace of Mind

Discover the unparalleled flexibility and security offered by our digital wallet solution. We understand that every bank has unique requirements, which is why our solution stands out in the following ways:

Tailored Solution for Banks

Flexible customization options aligned with your bank’s branding, user interface, and user experience. Personalization to meet specific regulatory requirements and compliance standardsAdaptability to accommodate unique features or functionalities desired by your bank.

Integration with Existing Systems

Seamless integration with your bank’s core banking systems and infrastructure.APIs and protocols for smooth integration, ensuring a cohesive ecosystem and interoperability.Data synchronization and real-time updates for a unified and synchronized banking experience.

Secure Data Exchange

Robust security measures protecting user data and transactionsEncryption protocols and secure communication channels that ensure the safeguarding of sensitive information.Compliance with data privacy regulations and industry standards, building and maintaining customer trust.

Scalable Architecture

Built on a scalable architecture to accommodate future growth and increased user demandHandling a growing user base, transaction volumes, and evolving market needs seamlessly. Scalable resources and infrastructure to provide a smooth and uninterrupted user experience.

EXPERTISE THAT BRINGS YOU VALUE

Get a Trusted Partner in Digital Wallet Development

Extensive Experience

Demonstrated history of providing customized digital wallet solutions of top-notch quality to financial institutions globally.

Compliance and Security

Emphasize adherence to regulations, safeguarding data privacy, and enhancing security measures to maintain the authenticity of user data and transactions.

Dedicated Technical Team

Dedicated developers, architects, and engineers offering high-quality tech solutions, ongoing training, and immediate assistance.

Collaborative Approach

Building strong relationships with clients and fostering transparent communication are essential for customizing solutions that meet their unique needs, ensuring successful project delivery.

STREAMLINED IMPLEMENTATION PROCESS

From Vision to Success

Our implementation process is designed to ensure a seamless and successful deployment of your digital wallet solution. We provide comprehensive support and guidance throughout the journey. Here’s a breakdown of the stages:

1 Requirement Gathering

- Work together to establish precise requirements and goals for the digital wallet solution.

- In-depth discussions to understand your bank’s unique needs and customization preferences.

- Create a detailed project roadmap and timeline for transparent implementation.

2 Solution Design and Customization

- Design the digital wallet solution architecture based on gathered requirements.

- Customize the solution to align with your bank’s branding and user experience.

- Ensure compliance with regulatory standards and security protocols.

3 Development and Integration

- Utilize our extensive technical knowledge to create a state-of-the-art digital wallet solution by harnessing cutting-edge technologies.

- systems and infrastructure, thanks to our seamless integration capabilities.

- Thoroughly test the solution to guarantee its stability, security, and functionality, ensuring a reliable and efficient digital wallet experience.

4 User Acceptance Testing

- Engage stakeholders and users to participate in user acceptance testing.

- Gather feedback and address any issues to optimize performance

- Conduct multiple rounds of testing for a robust and user-friendly experience

Company

Support

Copyright © 2024 Cloud Pay Fin Tech. All Rights Reserved